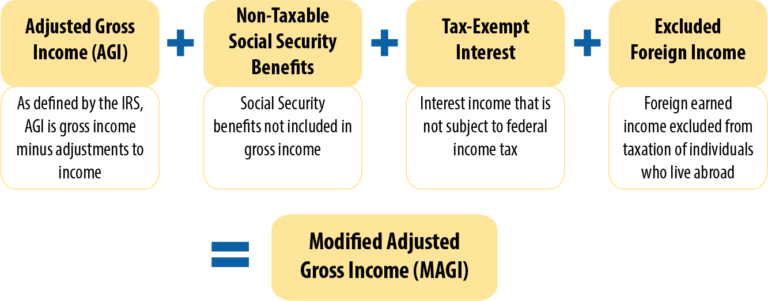

When you apply for premium tax credits and other financial assistance in MNSure, you’ll need to estimate your income for the upcoming year. For the purpose of estimating your income you will use your Modified Adjusted Gross Income - MAGI. For most taxpayers, the household Modified Adjusted Gross Income (MAGI) is the same as Adjusted Gross Income (AGI) which can be found on line 8b on a Form 1040. Taxpayers who receive non-taxable Social Security benefits, earn income living abroad, or earn non-exempt interest should add back that income to AGI to calculate MAGI.

Medicaid eligibility will be determined excluding the following types of income: scholarships, awards, or fellowship grants used for education purposes and not for living expenses, and certain American Indian and Alaska Native income derived from distributions, payments, ownership interests, real property usage rights, and student financial assistance. You'll provide this information on your Marketplace application.

Below is graphical representation on how to calculate MAGI.

You can start by adding up the following items for:

1. You and your spouse, if you’re married and will file a joint tax return

2. Any dependents who make enough money to be required to file a tax return

3. Which income sources to include

For each of the following sources, estimate what your income will be in

the upcoming year for which you’re applying for insurance. If you’re not sure what your income will be, make your best estimate.

1. Wages

2. Salaries

3. Tips

4. Net income from any self-employment or business (generally the amount of money you take in from your business minus your business expenses)

5. Unemployment compensation

6. Social Security payments, including disability payments -- but not Supplemental Security Income (SSI)

7. Alimony

Other items to include when estimating your income are: retirement income, investment income, pension income, rental income, and other taxable income such as prizes, awards, and gambling winnings.

Don't include the following kinds of income:

Child support

Gifts

Supplemental Security Income (SSI)

Veterans’ disability payments

Workers’ compensation

Proceeds from loans (like student loans, home equity loans, or bank loans)

Federal taxable wages

Don’t include as income any money that an employer takes out of your paycheck for child care, health insurance, or retirement plans that is “not taxable.” Sometimes these are called "pre-tax deductions." Your pay stub should list these deductions individually.

The pay stub may list your "federal taxable wages." If it does, use that figure to report your pay.

This info was gathered from Healthcare.gov